Indiana Tax Incentives

What to do when the Affordable Care Act Impacts Case Settlements:

The Benefits of an Accessibility-Focused Case Evaluation

A White Paper by Michael Fiore

One of the likely unintended consequences of the Affordable Care Act is that Special Need Trusts may be impacted due to settlement criteria that can be based on past, present, and future medical needs.

Teleseminars on Disability, Diversity, and the Changing Workforce. One hour of learning that can change the way that you think.

Tech Update: Read an article about the implications of 32-bit and 64-bit processors for Assistive Technology Solutions.

Looking for qualified candidates with disabilities?

![]()

A Job Board for job seekers with disabilities and the businesses looking to hire them.

Indiana Tax Incentives

- Assistive Technology Device Reutilization

- Assistive Technology Equipment Lending Library

- Assistive Technology Funding

- Capital Access Program

- Economic Development for a Growing Economy Tax Credit

- Hire a Vet

- Hoosier Business Investment Tax Credit

- Indiana Assistive Technology Project

- Indiana Chamber of Commerce

- Indiana Economic Development Corporation

- Industrial Recovery Tax Credit

- MED Works

- On-the-Job Training

- Skills Enhancement Fund

- Urban Enterprise Zone

- Vocational Rehabilitation Services

- Vocational Rehabilitation Services Area Offices

Assistive Technology Device Reutilization

Indiana Assistive Technology project operates an equipment reutilization program in which it accepts CCTV’s, video magnifiers, and other assistive technology devices. These items are sanitized, repaired and given to individuals with disabilities in Indiana for free.

Donated computers are received from donors, wiped of all previous data, refurbished and provided at no charge to individuals with disabilities who live in Indiana and have no other means of obtaining computers.

Device Reutilization Application and Agreement PDF

Assistive Technology Equipment Lending Library

Easter Seals Crossroads has an assistive technology loan program. It offers a variety of assistive technology devices for loan throughout the state of Indiana. These short-term loans assist their clients in making informed decisions about the assistive technology they might use at work, school or home.

Assistive Technology Funding

Indiana Assistive Technology Act provides low-interest extended rate financial loans to qualified individuals through the Alternative Financing Program. Alternative Financing Program loans are for assistive technology devices include, but not limited to hearing aids, augmentative communication devices, Braille equipment, computers, and environmental control units.

Capital Access Program

The Capital Access Program provides businesses with access to capital by encouraging lenders who participate in the program to make loans they would not ordinarily make. The CAP-SSBCI allows lenders to consider making slightly riskier loans that might not meet conventional small business lending requirements.

With the proceeds from this loan, a business can create more jobs. In doing so, it will increase the employment possibilities for workers with disabilities.

Capital Access Program Fact Sheet PDF

Economic Development for a Growing Economy Tax Credit

The Economic Development for a Growing Economy Tax Credit provides incentive to businesses to support jobs creation, capital investment and to improve the standard of living for Indiana residents. The refundable corporate income tax credit is calculated as a percentage (not to exceed 100%) of the expected increased tax withholdings generated from new jobs creation. The credit certification is phased in annually for up to 10 years based upon the employment ramp-up outlined by the business.

The job creation generated by this tax credit can lead to more job opportunities for workers with disabilities.

Economic Development Tax Credit Fact Sheet PDF

Hire a Vet

If your business needs an employee that is dependable, trustworthy, hardworking and well trained, then hire a veteran. Today’s veteran is one of the most highly-trained assets an employer can have in their workforce. The local WorkOne Center can assist with the hiring process. Their staff can review qualified applicants and only those who meet your specific needs will be referred to you. This will eliminate countless hours of screening potential applicants. Tax reduction and monetary reimbursement for certain eligible veterans are also offered to businesses that employ veterans. Work Opportunity Tax Credits are also available for hiring qualified veterans.

Hoosier Business Investment Tax Credit

The Hoosier Business Investment Tax Credit provides incentive to businesses to support jobs creation, capital investment and improve the standard of living for Indiana residents. The non-refundable corporate income tax credits are calculated as a percentage of the eligible capital investment to support the project. The credit may be certified annually, based on the phase-in of eligible capital investment, over a period of two full calendar years from the commencement of the project.

More jobs for workers with disabilities can be a positive outcome of this tax credit.

Hoosier Business Investment Tax Credit Fact Sheet PDF

Hoosier Business Investment Accelerated Tax Credit Fact Sheet PDF

Indiana Assistive Technology Project

Easter Seals Crossroads has been providing assistive technology solutions in Indiana since 1979. In 2007, Easter Seals Crossroads partnered with the State of Indiana, Bureau of Rehabilitative Services to establish the Indiana Assistive Technology Act Project. The Indiana Assistive Technology Act Project is one of 56 similar federally-funded projects designed to increase access and awareness of assistive technology.

Indiana Chamber of Commerce

The mission of the Indiana Chamber of Commerce is to cultivate a world-class environment which provides economic opportunity and prosperity for the people of Indiana and their enterprises.

Indiana Economic Development Corporation

The Indiana Economic Development Corporation is the state of Indiana's lead economic development agency. On its website are links to resources and other important information for Indiana businesses.

Industrial Recovery Tax Credit

The Industrial Recovery Tax Credit provides an incentive for companies to invest in former industrial facilities requiring significant rehabilitation or remodeling expenses.

Using this tax credit as an incentive, a company can remodel an old facility making it ADA compliant, allowing for employees with disabilities to be able to work in the newly rehabbed building.

Industrial Recovery Tax Credit Fact Sheet PDF

Industrial Recovery Tax Credit Application PDF

MED Works

MED Works is Medicaid for Employees with Disabilities. Many people with disabilities would like to return to work, but are fearful of losing their Medicaid benefits. MED Works is a program designed to allow these employees to work without fear of losing their Medicaid. MED Works offers the same coverage levels as regular Medicaid. There may be small monthly premiums based on the amount of money a worker earns.

On-the-Job Training

As a company grows and develops, so will its demand for a larger well-trained workforce. Expanding a workforce can be costly, but through the help of WorkOne, a business can reduce the cost of hiring and training new employees. WorkOne will reimburse employers up to 50% of new employee wages for on-the-job training.

THIS IS NOT A TAX CREDIT. It is an actual check sent to the company for a portion of the trainees’ wages during the training period of up to six months. The training must pay at least $10 per hour.

The new employee being trained could be a person with a disability who needs this type of preparation to secure employment.

Skills Enhancement Fund

The Skills Enhancement Fund provides assistance to businesses for training and upgrading skills of employees required to support new capital investment. The grant may be provided to reimburse a portion (typically 50%) of eligible training costs over a period of two full calendar years from the commencement of the project.

The employee receiving training through this fund could be someone with a disability who needs his/her skills updated to remain employed or advance in his/her career.

Skills Enhancement Fund Fact Sheet PDF

Urban Enterprise Zone

The Urban Enterprise Zone (UEZ) program was established under Ind. Code 5-28-15 to promote investment and increased economic activity in some of the most distressed urban areas around the state. There are currently 22 active UEZs in Indiana.

The following tax incentives are available to businesses and residents located or doing business within a UEZ (see Indiana Dept. of Revenue Information Bulletin 66 for a description of each):

- Employee Income Tax Deduction

- Employment Expense Credit

- Loan Interest Credit

- Investment Cost Credit

- Property Tax Investment Deduction

The increased economic activities that occurs as a result of this program could mean more employment opportunities for workers with disabilities in the designated zones.

Vocational Rehabilitation Services

Vocational Rehabilitation Services, a program of the Bureau of Rehabilitation Services, provides quality individualized services to enhance and support people with disabilities to prepare for, obtain or retain employment. The individual will work closely with a Vocational Rehabilitation Counselor throughout the process. Through active participation in their rehabilitation, people with disabilities achieve a greater level of independence in their work place and living environments.

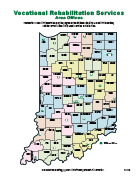

Vocational Rehabilitation Services Area Offices

This document has a map of Indiana divided by counties as well as the contact information for the Vocational Rehabilitation Services area office in each county.

Map Vocational Rehabilitation Services Offices PDF