Washington Tax Incentives

What to do when the Affordable Care Act Impacts Case Settlements:

The Benefits of an Accessibility-Focused Case Evaluation

A White Paper by Michael Fiore

One of the likely unintended consequences of the Affordable Care Act is that Special Need Trusts may be impacted due to settlement criteria that can be based on past, present, and future medical needs.

Teleseminars on Disability, Diversity, and the Changing Workforce. One hour of learning that can change the way that you think.

Tech Update: Read an article about the implications of 32-bit and 64-bit processors for Assistive Technology Solutions.

Looking for qualified candidates with disabilities?

![]()

A Job Board for job seekers with disabilities and the businesses looking to hire them.

Washington Tax Incentives

Page Contents

- Apprenticeship

- Association of Washington Business

- Customized Training Program

- Device Demonstration

- Division of Vocational Rehabilitation Offices

- High Unemployment County/Community Empowerment Zone

- Hiring Incentives - Division of Vocational Rehabilitation

- Industrial Revenue Bonds

- Industry Targeted Provisions and Programs

- Innovation Partnership Zones

- Job Skills Program

- Linked Deposit Program

- Microsoft Accessibility Resource Center

- On-the-Job Training

- Preferred Worker

- Rural County/Community Empowerment Zone Incentives

- Services for Employers - Division of Vocational Rehabilitation

- Stay at Work

- Tax Incentives Overview

- Veteran Linked Deposit Program

- Veteran Services

- Washington Access Fund

- Washington Small Business Credit Initiative

Apprenticeship

Apprenticeship combines classroom studies with on-the-job training supervised by a journey-level craft person or trade professional. In Washington State, the classroom studies are offered by a variety of providers, including employer sponsored schools, union sponsored schools, and Washington's community and technical colleges.

The person hired as an apprentice could be someone with a disability who needs this type of training to secure gainful employment.

This web page has links to the forms needed for applying to be an apprentice or for employers who want to hire one.

Association of Washington Business

The Association of Washington Business represents more than 8,100 private employers and works on their behalf to ensure Washington has the best business climate in the country to attract and retain jobs.

Customized Training Program

The Washington Customized Training Program provides interest-free training loan assistance to businesses that provide employment opportunities in the state. The Customized Training Program enhances the growth of Washington's economy, increases employment opportunities and adds to the state's quality of life.

The purpose of the Customized Training Program is to grow Washington’s economy by increasing employment opportunities, which could lead to more job possibilities for workers with disabilities.

Customized Training Program Guidelines DOC

Customized Training Program Application Form DOC

Device Demonstration

Through hands-on guidance of knowledgeable and experienced Assistive Technology Specialists, consumers receive impartial demonstrations of product features that will help accomplish tasks at school, work, home and in the community. This free service is offered by appointment to individuals with disabilities, their family members, and support providers at the Seattle location. Requests from outside the Seattle area are filled based on staff availability.

Division of Vocational Rehabilitation Offices

On this Vocational Rehabilitation Offices page, there is a map of Washington State with pins marking the location of every Vocational Rehabilitation office in the state. Click on a pin for more information and driving directions. Also on this page is a list of Vocational Rehabilitation offices alphabetized by county.

High Unemployment County/Community Empowerment Zone

To qualify for the High Unemployment County/Community Empowerment Zone incentive, a new or expanding business must do certain construction projects or purchase equipment.

This initiative could assist with a business’ workplace becoming ADA compliant, allowing for more workers with disabilities to be employed in its facilities.

Application for Sales and Use Tax Deferral PDF

Application for Sales and Use Tax Deferral for Lessor PDF

Hiring Incentives - Division of Vocational Rehabilitation

Division of Vocational Rehabilitation customers often qualify for hiring incentives such as Internal Revenue Service tax credits. The Division of Vocational Rehabilitation staff can help an employer receive payroll tax incentives of up to 40% of the first $6,000 of the employee’s first year wages. They can help answer questions, do the paperwork or connect the employer to the right IRS representative for assistance. Other tax credits are also available such as the Disabled Access Tax Credit, Welfare to Work Tax Credit, Architectural and Transportation Removal Deduction.

Industrial Revenue Bonds

Administered by the Washington Economic Development Finance Authority WEDFA, Industrial Revenue Bonds are low interest, tax free and a good option for a business that is building or expanding manufacturing or processing facilities,

With the proceeds from these bonds, a company can build a facility that is ADA compliant, allowing for more . workers with disabilities to be employed by that business.

Industry Targeted Provisions and Programs

Most of Washington State’s incentives are customized to meet the needs of specific industries. This web page has links to these industry-targeted provisions and programs.

Innovation Partnership Zones

Companies wanting to do business in Washington have the option of locating to an Innovation Partnership Zone IPZ. Each IPZ offers a unique environment that brings research, workforce training and private sector businesses together in close geographical proximity to create new companies, products and jobs.

Some of the jobs created in IPZs could be occupied by qualified workers with disabilities.

Job Skills Program

Job Skills training is a tool for enhancing economic growth and employment in Washington and funds training in regions with high unemployment rates and levels of poverty. It also supports areas with new and growing industries; locations where the local population does not have the skills needed to stay employed; and regions impacted by large-scale job loss.

The employee receiving training through the Job Skills Program could be someone with a disability who needs a skills upgrade to remain employed and advanced in his/her career.

Job Skills Program Guidelines PDF

Linked Deposit Program

The Linked Deposit Program was created to give minority and women owned businesses a way to access the capital, which had been historically denied to this group of entrepreneurs.

Linked Deposit Program Loan Enrollment Form PDF

Microsoft Accessibility Resource Center

A Microsoft Accessibility Resource Center provides expert consultation on assistive technology and accessibility features built into Microsoft products. Their specialists understand how disabilities impact computer users and are trained to evaluate the needs of the person with the disability. Some centers offer computer training and many organizations have lending libraries, so a consumer can try a product before purchasing it.

On-the-Job Training

On-the-job training gives employers the opportunity to train new employees to the specific needs and requirements of their respective business. The Division of Vocational Rehabilitation can offer employers financial reimbursement or assistance with costs associated with training a new employee from the Vocational Rehabilitation program. The Division of Vocational Rehabilitation can arrange for an employer to "try out" a Vocational Rehabilitation customer at the work site before making recruitment or hiring decisions. Work trial experience is often a mutually beneficial approach that provides the employer and job seeker the opportunity for evaluating the "right fit" of an occupation or industry.

Preferred Worker

The Preferred Worker Program is one of L&I’s return-to-work incentive programs. L&I may certify a worker with permanent medical restrictions as a “preferred worker.” This certification enables an employer to receive financial incentives when they hire the worker for a medically-approved, long-term job.

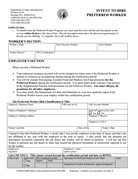

Preferred Worker Program Guidelines

Preferred Workers Status Application Docx

Intent to Hire Preferred Worker Application PDF

Intent to Hire Worker with Developmental Disabilities Application PDF

Rural County/Community Empowerment Zone Incentives

One of the purposes of the Rural County/Community Empowerment Zone incentive is to create new employment positions and increase instate employment by 15% resulting in more jobs for workers with disabilities.

Services for Employers - Division of Vocational Rehabilitation

The Division of Vocational Rehabilitation offers a variety of support services to assist employers with hiring and retaining Vocational Rehabilitation customers with disabilities.

Stay at Work

Stay at Work is a financial incentive that encourages employers to bring their injured workers quickly and safely back to light-duty or transitional work by reimbursing them for some of their costs.

This web page has directions and links to the forms needed to apply for reimbursement under the”Stay at Work” program.

Activity Prescription Form PDF

Tax Incentives Overview

This guide, published by the Washington State Department of Revenue, has information on tax provisions offered to businesses located in Washington State.

Veteran Services

In Washington State, WorkSource helps thousands of military veterans – including disabled veterans – find jobs each year. As a veteran, you can get priority access to WorkSource services. This includes priority referrals to jobs that are listed with WorkSource, as well as other employment services.

Veteran Linked Deposit Program

The Washington State Veteran Linked Deposit Program improves access to capital for certified Veteran and Service member owned business enterprises by decreasing interest rates on small business loans up to 2%.

Any firm currently certified by the Washington State Department of Veterans Affairs WDVA as a Veteran or Service member Owned Business is entitled to the Linked Deposit benefit. Any business related loan carried by a certified firm, and made by a participating lender, is eligible for enrollment in the program. A firm must be certified by WDVA before their business loan can be enrolled.

Linked Deposit Program Loan Enrollment Form PDF

Washington Access Fund

Assistive Technology loans can be used to purchase any device that helps to improve the functioning of a person with a disability. Business loans can be used to purchase any equipment needed by entrepreneurs and employees with disabilities.

Washington Small Business Credit Initiative

In Washington, the Department of Commerce has worked with private financial institutions to create four new programs whose $19.7 million in funds will deliver $300 million in new capital to Washington State small businesses by 2016. The programs are as follows:

- Capital Access Program (small businesses)

- Craft3 Fund (existing businesses that are considered "unbankable")

- W Fund (early stage science/tech companies from state universities and research centers)

- Collateral Support Program (small businesses)