Vermont Tax Incentives

What to do when the Affordable Care Act Impacts Case Settlements:

The Benefits of an Accessibility-Focused Case Evaluation

A White Paper by Michael Fiore

One of the likely unintended consequences of the Affordable Care Act is that Special Need Trusts may be impacted due to settlement criteria that can be based on past, present, and future medical needs.

Teleseminars on Disability, Diversity, and the Changing Workforce. One hour of learning that can change the way that you think.

Tech Update: Read an article about the implications of 32-bit and 64-bit processors for Assistive Technology Solutions.

Looking for qualified candidates with disabilities?

![]()

A Job Board for job seekers with disabilities and the businesses looking to hire them.

Vermont Tax Incentives

Page Contents

- Apprenticeships

- Assistive Technology Exchange in Vermont

- Assistive Technology Funding Resources

- Barrier-Free Employment for Vermonters of All Abilities

- Chamber of Commerce

- Creative Workforce Solutions

- Creative Workforce Solution Employer Toolkit

- Division of Vocational Rehabilitation

- On-The-Job Training Brochure

- Temp to Hire

- Unemployed Veteran Tax Credit

- Vermont Assistive Technology Program

- Vermont Assistive Technology Tryout Centers

- Vermont Economic Development Authority

- Vermont Employment Growth Incentive

- Vermont Training Program

- Veteran Services

Apprenticeships

VT Registered Apprenticeship is an employer-sponsored training program that includes both supervised work experience and related instruction. There are nearly 700 active apprentices in Vermont in over 25 different occupations.

Employers participate in Registered Apprenticeship by "sponsoring" individuals as apprentices. The employer sets a progressive wage scale, agrees to provide supervised on-the-job training, and helps financially support the related instruction component of the program.

A person with a disability who requires supervised, on-the-job training can become an apprentice to raise his/her skill level and gain the practical work experience needed to secure gainful employment.

Assistive Technology Exchange in Vermont

The goal of the Assistive Technology Exchange in New England & New York is to put Assistive Technology equipment that is not currently being used into the hands of someone who can benefit from it. The exchange is a free "classified ad" type resource designed to help people find, buy, sell or give away used Assistive Technology equipment.

Assistive Technology Funding Resources

This website has links and information on various assistive technology funding resources available in the State of Vermont.

Barrier-Free Employment for Vermonters of All Abilities

Individuals who have disabilities add a valuable dimension to any company. Tapping this talented pool of workers when hiring is good business, workers with disabilities rate high in performance, attendance, and productivity. People with disabilities can be found throughout the workforce and they represent a significant, untapped pool of capable workers that businesses can recruit to meet their workforce needs.

The staff at the Vermont Department of Labor can help employers streamline the process of finding, recruiting, hiring, and training workers. Recruiting the right employee and retaining existing, well trained, and productive workers is most important in today’s economy

Barrier Free Employment Brochure PDF

Chamber of Commerce

The Vermont Chamber of Commerce represents 1,500 businesses; a collective voice from Newport to Bennington, Vergennes to Groton, and every part of the state. In business since 1912, it is the largest state-wide private, non-profit business organization representing nearly every sector of the state's corporate/hospitality community-- from the smallest local entrepreneurs to some of the largest corporations in the world.

Creative Workforce Solutions (CWS)

Creative Workforce Solutions offers value to companies by uniquely addressing staffing challenges and needs. It provides all the services of a typical staffing agency with a focus on placing qualified workers who face challenges entering or re-entering the workforce. This allows employers to tap into an underutilized pool of talent plus benefit from additional incentives at no cost.

Creative Workforce Solutions will help identify the best and most cost-efficient hiring solutions for any business. A training fund has been established in Vermont to increase the use of alternative placement strategies as a tool to reduce any perception of risk on the part of employers. These funds can be used for arrangements such as work trials, internships, on-the-job training, and other options that may be of interest to employers.

Creative Workforce Solution Employer Toolkit

This is a comprehensive toolkit that addresses issues surrounding employment and disability, like, disability etiquette, workplace accommodations and financial incentives.

Creative Workforce Solution Employer Toolkit PDF

Division of Vocational Rehabilitation

Vocational Rehabilitation offers free, flexible services to any Vermonter or employer dealing with a disability that affects employment. We partner with human service providers and employers across Vermont to help people with disabilities realize their full potential.

On-The-Job Training Brochure

The Vermont Department of Labor's On-the-Job Training program helps a business defray some of the costs associated with hiring and training new workers while providing trainees with the most practical learning experience. The program operates on the proven premise that the employer will provide the best training.

With this program, a business can train potential employees, including those who have disabilities.

On-The-Job Training Program PDF

Temp to Hire

The "Temp to Hire" program is the result of a unique collaboration between the Vermont Division of Vocational Rehabilitation, VABIR and Triad Temporary Services. Each "Temp to Hire" is a six-week opportunity for employers and job seekers to work together toward a successful job match. In return for reduced payroll expenses, the employer agrees to provide training and support to the incoming worker. During the assessment period, the employer pays only the hourly wage.

The incoming worker who utilizes this training program to secure employment can be a Vermonter with a disability.

Unemployed Veteran Tax credit

In accordance with ACT 44 of 2011, employers who hire a recently separated veteran may be eligible to receive a tax credit of $2,000. Veterans who start their own business may receive up to a $2,000 tax credit.

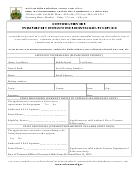

The first step to receiving the Unemployed Veteran Tax Credit is to have the Certification Form 44 completed by the Vermont Office of Veterans Affairs and the Vermont Department of Labor. The Certification document includes instructions for completion as well as more in-depth information about this program.

This tax provision can also cover businesses that employ veterans who have service related disabilities.

Vermont Assistive Technology Program

The Mission of the Vermont Assistive Technology Program is to increase awareness and knowledge, and to change policies and practices to ensure assistive technology is available through all services to Vermonters with disabilities.

Our Vision is that all individuals with disabilities receive the assistive technology they need and want, and that the benefits of assistive devices and technologies figure prominently in the minds of consumers, policy makers and service providers. This program seeks to create a dependable, consistent system of service delivery that is consumer driven and consumer responsive.

Vermont Assistive Technology Tryout Centers

The Vermont Assistive Technology Tryout Centers provide demonstrations, short term equipment loans, group trainings and technical assistance around the latest technology. The Centers’ services are available to consumers, caregivers, educators and service provider teams.

Vermont Economic Development Authority

For over three decades the Vermont Economic Development Authority has partnered with Vermont banks and other lenders to provide low-interest loans to Vermont businesses and farms, both large and small. Their loan officers have a combined total of over 150 years of lending experience.

Funds generated from these loans can be used by businesses to create job opportunities for employees with disabilities.

Vermont Employment Growth Incentive

The State of Vermont offers an economic incentive for business recruitment, growth and expansion. The Vermont Employment Growth Incentive program can provide a cash payment, based the revenue return generated to the State by prospective qualifying job and payroll creation and capital investments, to businesses that have been authorized to earn the incentive and who then meet performance requirements.

The purpose of the Vermont Employment Growth Incentive program is to promote economic development and employment in the State of Vermont. Part of this growth could be jobs for workers with disabilities.

Vermont Training Program

The Vermont Training Program partners with employers and training providers to train Vermont's employees for the jobs of tomorrow. Vermont Training Program provides performance based workforce grants for: pre-employment training, training for new hires and incumbent workers. Training can either be on-site or through a training provider/vendor. Grants may cover up to 50% of the training cost.

A worker with a disability who needs a skills upgrade will benefit from this program to remain a valued member of the workforce for his/her employer.

A worker with a disability who needs a skills upgrade will benefit from this program to remain a valued member of the workforce for his/her employer.

Veteran Services

Information for veterans who are seeking employment.