New Mexico Tax Incentives

What to do when the Affordable Care Act Impacts Case Settlements:

The Benefits of an Accessibility-Focused Case Evaluation

A White Paper by Michael Fiore

One of the likely unintended consequences of the Affordable Care Act is that Special Need Trusts may be impacted due to settlement criteria that can be based on past, present, and future medical needs.

Teleseminars on Disability, Diversity, and the Changing Workforce. One hour of learning that can change the way that you think.

Janet Fiore looks at the impact of ADA Amendments Act of 2008.

Looking for qualified candidates with disabilities?

![]()

A Job Board for job seekers with disabilities and the businesses looking to hire them.

New Mexico Tax Incentives

Page Contents

- Apprenticeships

- Division of Vocational Rehabilitation Locations

- Economic Development Department

- High Wage Jobs Tax Credit

- Investment Tax Credit for Manufacturers

- Job Training Incentive Program

- New Mexico Technology Assistance Financial Loan Programs

- Services for Employers - New Mexico Division of Vocational Rehabilitation

- Rural Jobs Tax Credit

- Technology Jobs and Research and Development Tax Credit

- The Loan Fund

- Veteran Employment Tax Credit

- WEEST Corporation

Apprenticeships

Apprenticeship is an "earn while you learn" training model that includes paid on-the-job training under the supervision of experienced journey workers with related classroom instruction to prepare individuals for skilled occupations.

The person hired as the apprentice could be someone with a disability who needs specialized on-the-job training to obtain employment.

New Mexico Manual for Developing Apprenticeships PDF

Division of Vocational Rehabilitation Locations

The Division of Vocational Rehabilitation Locations website allows you to click a city or town in New Mexico and the contact information and street location for the Division of Vocational Rehabilitation office in that area will appear on the screen.

Economic Development Department

The Economic Development Department website has important information and links for New Mexico’s businesses.

High Wage Jobs Tax Credit

A taxpayer who is an eligible employer may apply for and receive a tax credit for each new high-wage economic-base job. The credit amount equals 10% of the wages and benefits paid for each new economic-base job created.

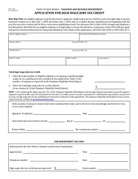

High Wage Jobs Tax Credit Application PDF.

Investment Tax Credit for Manufacturers

Manufacturers may take an Investment Tax Credit against gross receipts, compensating or withholding taxes equal to 5.125% of the value of qualified equipment when the following employment conditions are met:

- For every $500,000 of equipment, 1 employee must be added up to $30 million;

- For amounts exceeding $30 million, 1 employee must be added for each $1 million of equipment

The employees that a manufacturer adds to qualify for this provision can be workers with disabilities.

Investment Tax Credit Schedule A PDF

Investment Tax Credit Claim Form PDF

Investment Tax Credit Application PDF

Job Training Incentive Program

New Mexico has one of the most generous training incentive programs in the country. The Job Training Incentive Program funds classroom and on-the-job training for newly-created jobs in expanding or relocating businesses for up to 6 months. The program reimburses 50-75% of employee wages. Custom training at a New Mexico public educational institution may also be reimbursed.

This program can help people with disabilities get the vocational training they need to secure gainful employment.

To begin the Job Training Incentive Program application process, take the Eligibility Questionnaire.

Job Training Incentive Program PDF

New Mexico Technology Assistance Program Financial Loan Programs

Securing loans to purchase devices can be difficult. The New Mexico Technology Assistance Program partners with the community based organization, San Juan Center for Independence and area banks. It offers individuals with disabilities affordable loan solutions statewide that enable the purchase of equipment needed to succeed in business or life in general.

Services for Employers – New Mexico Division of Vocational Rehabilitation (DVR)

The Division of Vocational Rehabilitation offers the following services to employers who hire people with disabilities:

- Placement Services – Low-cost matching qualified candidates to employer’s work environment. the

- ADA Consultation – Provides knowledge about the ADA and its implementations.

- On-The-Job Training - Provides actual skill development on an individual basis at little or no cost to an employer of a person with a disability.

- Tax Incentive – Provides information to employers on business tax credits and other incentives relevant to employing people with disabilities.

DVR Employer Services offers a cost-effective alternative to advertising for job candidates. We offer discreet placement services for job-ready individuals to help you achieve your hiring goals.

Rural Jobs Tax Credit

To be eligible for the Rural Jobs Tax Credit, a company must manufacture or produce a product in New Mexico or be a non-retail service company that exports a substantial percentage of services out of state (50% or more revenues and/or customer base). Certain green industries can qualify too. This credit can be applied to taxes due on (state) gross receipts, corporate income or personal income tax.

Some of the jobs created as a result of this credit could be occupied by employees with disabilities.

Rural Jobs Tax Credit Eligibility PDF

Rural Jobs Tax Credit Claim Form PDF

Rural Jobs Tax Credit Application PDF

Technology Jobs and Research and Development Tax Credit

A taxpayer that employs no more than 50 employees, has qualified expenditures of no more than $5 million, and who conducts qualified research and development at a facility in New Mexico is allowed a basic tax credit equal to 5% of qualified expenditures, and an additional 5% credit toward income tax liability by raising its in-state payroll $75,000 for every $1 million in qualified expenditures claimed. The tax credit doubles for expenditures in facilities located in rural New Mexico (as defined for this tax credit as anywhere outside a three-mile radius of an incorporated municipality with a population of 30,000 or more.

This tax credit can be used as an incentive for R&D companies in New Mexico to employ more researchers with disabilities.

Technology Jobs and Research and Development Tax Credit Notice of Distribution PDF

Technology Jobs and Research and Development Tax Credit Claim Form PDF

Technology Jobs and Research and Development Tax Credit Application PDF

The Loan Fund

The Loan Fund provides loans and assistance to improve the economic and social conditions of New Mexicans.

With financial assistance from The Loan Fund, jobs held by employees with disabilities can be created.

Veteran Employment Tax Credit

The Veteran Employment Tax Credit will provide up to $1,000 to businesses each time they hire a veteran who has recently been discharged from the military.

WEEST Corporation

WESST is a statewide small business development and training organization committed to growing New Mexico’s economy by cultivating entrepreneurship. The staff’s passion, counsel, hard work, experience and commitment are the inspiration and behavior model they offer their clients so that they can realize their entrepreneurial dreams and achieve economic success.