New Jersey Tax Incentives

What to do when the Affordable Care Act Impacts Case Settlements:

The Benefits of an Accessibility-Focused Case Evaluation

A White Paper by Michael Fiore

One of the likely unintended consequences of the Affordable Care Act is that Special Need Trusts may be impacted due to settlement criteria that can be based on past, present, and future medical needs.

Teleseminars on Disability, Diversity, and the Changing Workforce. One hour of learning that can change the way that you think.

Tech Update: Read an article about the implications of 32-bit and 64-bit processors for Assistive Technology Solutions.

Looking for qualified candidates with disabilities?

![]()

A Job Board for job seekers with disabilities and the businesses looking to hire them.

New Jersey Tax Incentives

Page Contents

- Assistive Technology Advocacy Center

- Bond Financing

- Business Employment Incentive Grant

- Business Retention and Relocation Assistance Act

- Chamber of Commerce

- Device Demonstration

- Device Loans

- Device Reutilization

- Economic Development Authority

- Economic Recovery Tax Credit

- Financing Assistive Technology

- Grow New Jersey Assistance Program

- Manufacturing Equipment and Employment Investment Tax Credit

- Microsoft Accessibility Resource Center

- New Jersey Advantage Program

- New Jersey Apprenticeship Program

- New Jersey SmartStart Buildings Program

- New Jersey Workability Program

- New Jobs Investment Tax Credit

- Real Estate Impact Fund

- Redevelopment Authority Project Tax Credit

- Research and Development Tax Credit

- Small Business Fund

- Supported Employment

- Urban Enterprise Zone Program

- Urban Transit Hub Tax credit Program

Assistive Technology Advocacy Center

The Assistive Technology Advocacy Center serves as New Jersey's federally funded assistive technology project through a sub-contract with New Jersey's Department of Labor and Workforce Development. Its purpose is to assist individuals in overcoming barriers in the system and making assistive technology more accessible to individuals with disabilities throughout the state.

Assistive Technology (AT) is a term that describes devices and products created and used to help people with disabilities live more independently. Some examples of AT are: manual and motorized wheelchairs, augmentative communication devices, reaching and grabbing aids, ramps, lifts, grab bars and adapted vehicles.

Bond Financing

Creditworthy manufacturing companies, 501(c)(3) not-for-profit organizations, and exempt facilities in New Jersey may be eligible for long-term financing under the Bond Financing Program.

With funding from this program, New Jersey businesses can renovate a workplace to make it accessible to employees who use wheelchairs.

Business Employment Incentive Grant

The Business Employment Incentive Grant is a grant awarded by the EDA where the business meets certain enumerated criteria. A business may apply to the authority for a grant for any project which: will create at least 25 eligible positions in the base years; or will create at least 10 eligible positions in the base years if the business is an advanced computing company, an advanced materials company, a biotechnology company, an electronic device technology company, an environmental technology company, or a medical device technology company. In the case of a business which is a landlord, the business may apply to the authority for a grant for any project in which at least 25 eligible positions are created in the base years.

Some of the jobs created to meet the requirements of this grant could be held by employees with disabilities.

Business Retention and Relocation Assistance Act

The purpose of the Business Retention and Relocation Assistance program is to encourage economic development and job creation and to preserve jobs that currently exist in New Jersey, but which are in danger of being relocated outside of the State. To qualify for a grant of tax credits, a business shall demonstrate that it will either relocate to or maintain facilities in New Jersey and that the relocation/retention* of at least 50 employees and capital investments have a net positive effect on New Jersey. The business shall also demonstrate that the receipt of assistance will be a material factor its' decision not to relocate outside of New Jersey; provided however, that a business that relocates 1,500 or more retained full-time jobs covered by a project agreement from outside of a designated urban center to one or more new locations within a designated urban center shall not be required to make such a demonstration if the business applies for a grant of tax credits within six months of signing its lease or purchase agreement.

The jobs created or preserved as a result of this program could be occupied by workers with disabilities.

Business Relocation Tax Credit Application PDF

Chamber of Commerce

The New Jersey Chamber of Commerce is a business advocacy organization based in Trenton. Created in 1911, the State Chamber staff represents its members on a wide range of business and education issues at the State House and in Washington. The organization also links the state’s local and regional chambers on issues of importance through its grassroots legislative network.

Device Demonstration

Device demonstrations are used to display the most recent devices and offer training on specific devices to meet an individual’s needs. Demonstration centers provide hands-on training and evaluation of assistive technology devices and services to enhance the everyday activities of persons with disabilities.

Device Loans

Device loans provide necessary equipment to consumers for a period of time, either free of charge or for a minimal fee. These loans allow consumers to test devices prior to purchase or have access to a backup system when their current device is being repaired.

Device Reutilization

Device reutilization includes both the repair and recycling of equipment, as well as exchange programs. Device repair and recycling programs are those in which pre-owned devices are restored and then offered to consumers as recycled products. Device exchange programs involve the arrangement of purchase of the pre-owned item directly from the current owner to the consumer.

Economic Development Authority

If you are a business in need of financing to grow in New Jersey, a nonprofit organization seeking capital to expand community services, a municipality looking to attract a major corporation within your boundaries, or a developer requiring funds for a major redevelopment project, the New Jersey Economic Development Authority (EDA) is ready to put its resources to work for you.

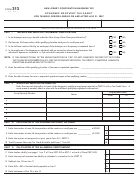

Economic Recovery Tax Credit

The purpose of the Economic Recovery Tax Credit is to foster business investment in qualified municipalities established under the authority of the "Qualified Municipality Open For Business Incentive Program". The credit is equal to $2,500 for each new full-time position at that location in credit year one and $1,250 for each new full-time position at that location in credit year two.

Job creation resulting from this tax credit could mean more employment opportunities for workers with disabilities.

To claim this credit, the taxpayer must complete Form 313 and attach it to the tax return.

Financing Assistive Technology

There are several programs that provide loan services and other types of financial assistance to individuals with disabilities in New Jersey who want to purchase assistive technology. Links to these programs and a brief description of each one can be found on this website.

Grow New Jersey Assistance Program

Grow NJ is a powerful job creation and retention incentive program that strengthens New Jersey's competitive edge against tax incentive programs in surrounding states. Businesses that are creating or retaining jobs in New Jersey may be eligible for tax credits ranging from $500 to $5,000 per job, per year; with bonus credits ranging from $250 to $3,000 per job, per year (award amounts vary based on applicable criteria.)

More jobs for workers with disabilities can be a positive outcome of this program.

Go to this web page to start the application process.

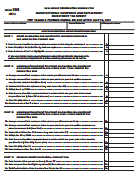

Manufacturing Equipment and Employment Investment Tax Credit

The Manufacturing Equipment and Employment Investment Tax Credit provides the taxpayer with incentive to increase employment at New Jersey locations by investing in manufacturing equipment.

Workers with disabilities looking for manufacturing jobs could find meaningful work because of the increased employment opportunities supported by this tax provision.

Manufacturing Equipment and Employment Investment Tax Credit Application PDF

Microsoft Accessibility Resource Center

A Microsoft Accessibility Resource Center provides expert consultation on assistive technology and accessibility features built into Microsoft products. Their specialists understand how disabilities impact computer users and are trained to evaluate the needs of the person with the disability. Some centers offer computer training and many organizations have lending libraries, so a consumer can try a product before purchasing it.

New Jersey Advantage Program

Creditworthy New Jersey business in need of financing and committed to job creation/retention in New Jersey may be eligible for financing through the New Jersey Advantage Program, a joint program of the EDA and TD Bank.

New Jersey businesses can create or retain more jobs – possibly leading to an increase in employment opportunities for workers with disabilities – with financial support from this program.

New Jersey Apprenticeship Program

Registered apprenticeships are an earn-while-you-learn approach to launching an excellent career in hundreds of different occupations. Apprentices receive a combination of on-the-job training and related technical instruction to master the practical and theoretical aspects of a skilled occupation.

New Jersey SmartStart Buildings Program

New Jersey’s SmartStart Building Program is administered by New Jersey’s Office of Clean Energy. Whether you’re starting a commercial or industrial project from the ground up, renovating existing space, or upgrading equipment, New Jersey has unique opportunities to upgrade the quality of the project.

Assistance from this program can make an old building ADA compliant for employees with disabilities.

New Jersey Workability Program

Many people with disabilities choose not to work because of fear of loosing their health insurance benefits. The Workability Program solves this problem. NJ Workability is a program that allows certain employed people with permanent disabilities, whose earnings are too high for them to qualify otherwise for Medicaid coverage, to receive full New Jersey Medicaid benefits. In some instances, people who qualify for the program may have to pay a monthly premium of $25 per month for one person or $50 per month for a couple. The web site also has further details on eligibility and income/resource guidelines

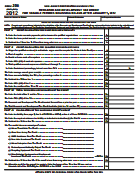

New Jobs Investment Tax Credit

This Corporation Business Tax Credit is available for investments made in new or expanded business facilities that creates at least 5 new jobs in New Jersey. This tax credit can also pass through to principals of Subchapter-S corporations.

To reverse the staggeringly high rate of unemployment among people with disabilities, the New Jobs Investment Tax Credit can be used to encourage the hiring of more people with disabilities.

The following form must be completed to receive the New Jobs Investment Tax Credit:

New Jersey New Jobs Tax Credit form PDF

Real Estate Impact Fund

For profit and non-profit developers and business entities with demonstrated experience in successfully completing real estate development projects may be eligible for financing of up to $3 million for costs associated with projects located within Targeted Areas.

The goal of the Real Estate Impact Fund is to support and foster redevelopment in strategic urban and other significant locations that would not otherwise occur in the near term and to strengthen existing and catalyze future development opportunities and private investment. The Impact Fund will advance economic development by supporting projects consistent with local redevelopment plans or strategies, attract private investment, and by creating or retaining jobs.

The jobs that are established as an end result of this fund could mean more employment possibilities for job seekers in these targeted areas who are disabled.

Go to this web page to start the application process.

Real Estate Impact Fund Application Checklist PDF

Redevelopment Authority Project Tax Credit

The credit is $1,500 each year for two years for new employees that were unemployed or on public assistance prior to joining a manufacturing company in the project area. The Redevelopment Authority Project Tax Credit is allowed in the tax year following the tax year of qualification, and may be continued into a second tax year if such qualification continues. Any credit which remains after the second tax year following the tax year of qualification is forfeited.

The new employees that a company hires to qualify for this tax provision could be workers with disabilities who were on public assistance or unemployed before obtaining their new positions.

Redevelopment Authority Project Tax Credit Application PDF

Research and Development Tax Credit

A taxpayer that has performed qualified research activities in New Jersey may be eligible to claim the Research and Development Tax Credit.

Companies that conduct R&D activities could hire more researchers, including ones who have disabilities.

Research and Development Tax Credit Application PDF

Small Business Fund

Creditworthy small, minority-owned or women-owned businesses in New Jersey that have been in operation for at least one full year and may not have the ability to get bank financing, or not-for-profit corporations that have been operating for at least three full years, may be eligible for assistance under the Small Business Fund.

With assistance from this fund, a small business can create more jobs, which could lead to more employment opportunities for workers with disabilities.

Supported Employment

For employers who are interested in knowing about supported employment and the services available to disabled employees, this web site contains information on these types of supports. Supports can be job coaching to help the employee familiarize him/herself with the work or vocational counseling to assist with other aspects of maintaining employment. Supports can last up to 90 days after the person is employed.

Urban Enterprise Zone Program

The New Jersey Urban Enterprise Zone Program was created to stimulate economic development and job creation in the State's designated zones. Participating businesses located in these zones are eligible to receive the following incentives: sales tax exemptions for building materials and equipment etc., corporate tax benefits and unemployment rebates.

Very often, people with disabilities live in urban areas that are depressed and in need of revitalization. Hiring disabled individuals from these zones would reverse the unemployment trend among this population and give their neighborhoods a must needed lift.

Urban Transit Hub Tax Credit Program

A Urban Transit Hub Credit may be awarded to businesses for capital investments made in qualified business facilities that are located within eligible municipalities approved by the Economic Development Authority. The business must have at least $50,000,000 in capital investments into a qualifying facility. A tenant of the business can qualify if there at least $17,500,000 in capital investments made in the area being leased in the qualifying facilities. Additionally, 250 new fulltime employees, who are subject to the New Jersey Gross Income Tax or are from a state which has reciprocity with New Jersey, must have been hired. The 250 employee threshold can be met by an aggregate of no more than three tenants.

Some of the workers hired to fulfill the new employee requirements can be people with disabilities.