Kentucky Tax Incentives

What to do when the Affordable Care Act Impacts Case Settlements:

The Benefits of an Accessibility-Focused Case Evaluation

A White Paper by Michael Fiore

One of the likely unintended consequences of the Affordable Care Act is that Special Need Trusts may be impacted due to settlement criteria that can be based on past, present, and future medical needs.

Teleseminars on Disability, Diversity, and the Changing Workforce. One hour of learning that can change the way that you think.

Tech Update: Read an article about the implications of 32-bit and 64-bit processors for Assistive Technology Solutions.

Looking for qualified candidates with disabilities?

![]()

A Job Board for job seekers with disabilities and the businesses looking to hire them.

Kentucky Tax Incentives

Page Contents

- Assistive Technology – Device Demonstration

- Assistive Technology – Lending Library

- Assistive Technology – Reutilization

- Cabinet for Economic Development

- Chamber of Commerce

- Grant-in-Aid

- Kentucky Assistive Technology Loan Corporation

- Kentucky Assistive Technology Service Network

- Kentucky Business Incentives

- Kentucky Business Investment

- Kentucky Economic Development Finance Authority Small Business Loan Program

- Kentucky Industrial Revitalization Act

- Kentucky Reinvestment Act

- Kentucky Small Business Credit Initiative

- Kentucky Small Business Tax Credit

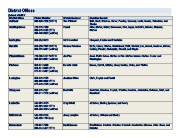

- Office of Vocational Rehabilitation – District Offices

- Office of Vocational Rehabilitation – Employer Services

- Skills Training Investment Credit

- The Buck Starts Here: A Guide to Assistive Technology in Kentucky

Assistive Technology – Device Demonstration

The Assistive Technology Demonstration Centers provide a place for people of all ages and disabilities, their family members/caregivers as well as educators, healthcare providers and other professionals to learn about and try out the latest Assistive Technology .

Assistive Technology – Lending Library

The network of lending library programs offers individuals the opportunity to borrow assistive technology equipment on a short-term basis. Requests for devices can be made by a consumer with a disability, a family member, friend or advocate, or rehabilitation professional.

Assistive Technology – Reutilization

The Kentucky Assistive Technology Service Network maintains an Assistive Technology Exchange List, similar to classified ads or "Craig's List". The Assistive Technology Exchange List helps people with disabilities and anyone with functional limitations find affordable assistive technology, devices and equipment.

Cabinet for Economic Development

The Cabinet for Economic Development is the primary state agency in Kentucky responsible for encouraging job creation and retention, and new investment in the state. Programs administered by the Cabinet are designed to support and promote economic development, primarily by attracting new industries to the state, assisting in the expansion of existing industries, leading a statewide network of support for entrepreneurs, small business owners and knowledge-based start-up entities, and assisting communities in preparing for economic development opportunities.

Chamber of Commerce

The Kentucky Chamber of Commerce is the only business association in the state advocating for companies of all sizes and industries across the Commonwealth.

Grant-in-Aid

The competitive grant-in-aid program's basic purpose is to improve and promote employment opportunities for the residents of Kentucky through training grants with business and industry. The Grant-in-Aid program provides up to 50% reimbursement of eligible costs to companies/consortia for approved training activities. Consortia projects, which promote collaborative training initiatives for companies that have common training needs, must be industry driven and be a partnership between business/industry, education, and government working together to maximize the effectiveness of the current and future workforce. The following firms are eligible to apply for BSSC funds: manufacturing; service and technology (non-retail); public or non-profit hospitals; and training consortia with three or more eligible companies. Any business whose primary purpose is the sale of goods at retail does not qualify.

The following training types are allowed under Grant-in-Aid guidelines: in-house training; educational institution and consultant training; instructional materials, texts and supplies; train-the-trainer travel; trainee wages and registered apprenticeship training – year one apprentices.

This grant program can enable a worker with a disability to obtain the skills training he/she needs to be successful at work.

Kentucky Assistive Technology Loan Corporation

The Kentucky Assistive Technology Loan Corporation offers low interest loans for qualified applicants with disabilities who need assistive technology. Working with its lending partner, Fifth Third Bank, the Kentucky Assistive Technology Loan Corporation can provide loans for modified vehicles, hearing aids, adapted computers, mobility devices, augmentative communication devices or any other type of equipment or home modification that will improve the quality of life or increase the independence of Kentuckians with disabilities.

Kentucky Assistive Technology Loan Corporation Brochure PDF

Kentucky Assistive Technology Loan Corporation Application DOC

Kentucky Assistive Technology Service Network

The Kentucky Assistive Technology Service Network serves as the Assistive Technology Act Program for the State of Kentucky. Their mission is to make assistive technology information, devices and services easily obtainable for people of any age and/or disability, their families, employers and employment service providers, educators, healthcare and social service providers.

Kentucky Business Incentives

Kentucky offers a number of progressive incentives for businesses. This document offers general summaries on these programs.

Kentucky Business Incentives Summary PDF

Kentucky Business Investment

The Kentucky Business Investment Program provides income tax credits and wage assessments to new and existing agribusinesses, regional and national headquarters, manufacturing companies, and non-retail service or technology related companies that locate or expand operations in Kentucky.

The business expansion generated by this program could mean an increase in employment opportunities for workers with disabilities.

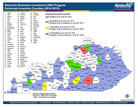

Projects locating in certain counties may qualify for enhanced incentives. This is a map of the enhanced incentive counties.

Map of the Enhanced Incentive Counties PDF

Kentucky Business Investment Fact Sheet PDF

Kentucky Economic Development Finance Authority Small Business Loan Program

Small businesses engaged in the manufacturing, agribusiness or service and technology fields often need to update or purchase equipment to remain competitive in today’s marketplace, but often securing those funds through traditional lenders can prove difficult for a variety of reasons. The Kentucky Economic Development Finance Authority under the direction of the Cabinet for Economic Development and the Office of Entrepreneurship can offer fixed rate loans for projects like these.

The jobs created as a result of these business loans can be held by workers with disabilities.

Small Business Loan Program Guidelines PDF

Kentucky Industrial Revitalization Act

Companies approved under the Kentucky Industrial Revitalization Act may receive state income tax credits, Kentucky Corporation License Fee credits, and job assessment fees for up to ten (10) years limited to seventy-five percent (75%) of the costs of the rehabilitation or construction of buildings and the refurbishing or purchasing of machinery and equipment.

Kentucky Industrial Revitalization Fact Sheet PDF

Kentucky Reinvestment Act

Any Kentucky company engaged in manufacturing and related functions can receive financial assistance with the purchase of eligible equipment or obtaining skills training for their employees. Costs must be approved by the Kentucky Economic Development Finance Administration for recovery.

The skills upgrade available through this Act can benefit a worker who has a disability and needs his/her skills to be updated in order to remain gainfully employed.

Kentucky Reinvestment Act Fact Sheet PDF

Kentucky Small Business Credit Initiative

The Kentucky Small Business Credit Initiative includes three distinct credit enhancement programs designed to generate jobs and increase the availability of credit to small businesses by reducing the risk participating lenders, credit unions, and community development financial institutions assume. Kentucky Small Business Credit Initiative will leverage funding from these private lenders to help finance creditworthy small businesses that would typically fall just outside a lender’s normal underwriting standards.

The three programs that compose Kentucky Small Business Credit Initiative are:

- Kentucky Capital Access Program

- Kentucky Loan Participation Program

- Kentucky Collateral Support Program

With assistance through this initiative, Kentucky small businesses can receive the funding to create jobs, which could mean more employment opportunities for workers with disabilities.

Kentucky Small Business Credit Initiative Fact Sheet PDF

Kentucky Small Business Tax Credit

The Kentucky Small Business Tax Credit program is designed to encourage small business growth and job creation. With certain exceptions, most for-profit businesses with 50 or fewer full-time employees are considered eligible. The tax credit for which a business may be eligible could total between $3,500 and $25,000, depending on the number of employees that are hired and the total amount of investment in equipment or technology.

The business growth that occurs as a result of this tax credit could mean an increase in job opportunities for workers with disabilities.

Kentucky Small Business Tax Credit Fact Sheet PDF

Kentucky Small Business Tax Credit Guidelines PDF

Kentucky Small Business Tax Credit Application XLS

Office of Vocational Rehabilitation – District Offices

See the directory or local district office directory to contact the office nearest you.

Office of Vocational Rehabilitation – Employer Services

The Kentucky Office of Vocational Rehabilitation Employer Services assists businesses in hiring, developing and keeping valued employees. It provides an array of services at no cost. The Office of Vocational Rehabilitation wants to work with your business toward placement and retention of persons with disabilities in the workforce. Its custom-designed programs and services exemplify your tax dollars at work for Kentucky's business and industry.

Skills Training Investment Credit

The Skills Training Investment Credit program's basic purpose is to improve and promote of the overall eligible training. The Skills Training Investment Credit allows tax credits for up to 50% of eligible training costs.

Through this program, workers with disabilities can get the job training they need to advance in their careers and their employers will benefit because of the tax credit they receive for providing it.

Skills Training Investment Credit Fact Sheet PDF

Skills Training Investment Credit Application xls

Skills Training Investment Credit Guidelines PDF

The Buck Starts Here: A Guide to Assistive Technology in Kentucky

The Buck Starts Here: A Guide to Assistive Technology in Kentucky is designed to be a guide for anyone who needs financial assistance to purchase assistive technology as an aid to independent functioning and improved quality of life.

.jpg)