Georgia Tax Incentives

What to do when the Affordable Care Act Impacts Case Settlements:

The Benefits of an Accessibility-Focused Case Evaluation

A White Paper by Michael Fiore

One of the likely unintended consequences of the Affordable Care Act is that Special Need Trusts may be impacted due to settlement criteria that can be based on past, present, and future medical needs.

Teleseminars on Disability, Diversity, and the Changing Workforce. One hour of learning that can change the way that you think.

Tech Update: Read an article about the implications of 32-bit and 64-bit processors for Assistive Technology Solutions.

Looking for qualified candidates with disabilities?

![]()

A Job Board for job seekers with disabilities and the businesses looking to hire them.

Georgia Tax Incentives

- Assistive Technology Device Demonstration

- Assistive Technology Funding Options

- Assistive Technology Resource Center

- Bond Allocation Program

- CDBG Loan Guarantee Program

- Chamber of Commerce

- Economic Development Finance Programs

- EDGE Fund

- Employment Incentive Program

- Enterprise Zone Program

- Entrepreneur and Small Business Development Loan Guarantee Program

- Equity Fund

- Georgia Department of Economic Development

- Georgia Job Tax Credit Program

- Georgia Quick Start

- Investment Tax Credit

- Life Science Facilities Fund

- Mega Project Tax Credits

- Military Zone Job Tax Credit

- Opportunities Zones

- Quality Jobs Tax Credit

- Regional Economic Business Assistance (REBA) Program

- Research and Development Tax Credit

- Retraining Tax Credit

- Tools for Life

- Vocational Rehabilitation Services for Employers

Assistive Technology Device Demonstration

To increase understanding of the types of devices that can help with a specific need, device demonstrations are available to people with disabilities and their families, as well as providers of education, health, employment and related services.

Assistive Technology Funding Options

The Assistive Technology Funding Options website lists resources that assist with purchasing assistive technology or obtaining it through other means.

Assistive Technology Resource Center

Visit an Assistive Technology Resource Center to learn more about assistive technology devices and to try before you buy!

Bond Allocation Program

The Bond Allocation Program is for companies that will create jobs or expand access to affordable housing. Part of the expansion it generates could be jobs for employers with disabilities.

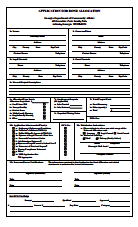

Bond Allocation Program Application PDF

CDBG Loan Guarantee Program

In order for a project to be eligible for the CDBG Loan Guarantee Program, it must meet all applicable CDBG requirements and result in significant employment and/or benefit for low and moderate income persons.

The purpose of this program is to create better employment opportunities for individuals who have a low to moderate income, like many people with disabilities. This program could raise the income level of this population by financing projects that will create jobs that could be held by workers who are disabled.

Section 108 Program Fact Sheet PDF

CDBG Loan Guarantee Program Manual PDF

Chamber of Commerce

Georgia’s Chamber of Commerce is the largest business advocacy organization. Its focus is on keeping, growing and creating new jobs in the State. The Chamber has an aggressive, proactive approach to state policy issues, and transcends regional boundaries to create a state-wide network of business leaders working to help Georgia's economy thrive.

Economic Development Finance Programs

The Economic Development Finance Programs packet contains information about various federal, state and local financing programs that directly or indirectly benefit Georgia businesses or those businesses interested in making Georgia their home. It also includes information on the Secretary of State's First Stop Business Information Center and the Small Business Administration.

Economic Development Financing Packet PDF

EDGE Fund

The purpose of the EDGE Fund is to provide financial assistance to eligible applicants that are being considered as a relocation or expansion site and are competing with another state for location of a project; and, where the EDGE Fund is used when the health, welfare, safety and economic security of the citizens of the state are promoted through the development and/or retention of employment opportunities.

The expansion that is generated by this fund could mean jobs for people with disabilities.

Guidelines for applying for the EDGE Fund.

EDGE Fund Application Instructions PDF

EDGE Fund Application Forms PDF

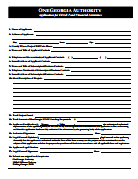

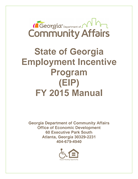

Employment Incentive Program

The Employment Incentive Program is a financing program that may be used in conjunction with traditional private financing to carry out economic development projects which will result in employment for low and moderate income persons.

Many types of projects can be financed with Employment Incentive Program funding. However, projects creating opportunities for low and moderate income persons to advance themselves by obtaining employment, greater job security, better working conditions, job training, enhancement of workplace skills and advancement opportunities receive the greatest consideration.

The purpose of this program is to create better employment opportunities for individuals who have a low to moderate income, like many people with disabilities. This program could raise the income level of this population by financing projects that will create jobs that are better paying and offer stability.

Employment Incentive Program Fact Sheet PDF

Employment Incentive Program Manual PDF

Enterprise Zone Program

The State Enterprise Zone Program intends to improve geographic areas within cities and counties that are suffering from economic decline by encouraging private businesses to reinvest and rehabilitate such areas.

Often, people with disabilities live in communities that are economically disadvantage. Proper utilization of this program will reverse this trend and increase employment opportunities for this population as well.

Entrepreneur and Small Business Development Loan Guarantee Program

By partnering with accredited Georgia financial institutions, the OneGeorgia Authority will provide new financial resources and opportunities for business development in Georgia’s at-risk areas through the Entrepreneur and Small Business Development Loan Guarantee Program. The OneGeorgia Authority and accredited Georgia financial institutions will provide entrepreneurs and small business owners with access to loans ranging from $35,000 up to $250,000 at competitive interest rates.

Equity Fund

The purpose of the Equity Fund is to provide a program of financial assistance that includes grants, loans and any other forms of assistance authorized by (O.C.G.A.50-34-1 et seq.) to finance activities that will assist applicants in promoting the health, welfare, safety, and economic security of the citizens of the state through the development and retention of employment opportunities in areas of greater need as defined by the Georgia Business Expansion and Support Act of 1994, as amended (O.C.G.A.48-7-40).

The development of employment opportunities brought about by the Equity Fund may mean more jobs for workers with disabilities.

Guidelines for applying for the Equity Fund.

Equity Fund Application Instructions PDF

Georgia Department of Economical Development

The Georgia Department of Economic Development is the state's sales and marketing arm and lead agency for attracting new business investment, encouraging the expansion of existing industry and small businesses, developing new domestic and international markets, attracting tourists to Georgia, and promoting the state as a location for film, video, music and digital entertainment projects, as well as planning and mobilizing state resources for economic development.

Georgia Job Tax Credit Program

Georgia Job Tax Credit Program

Job Credit Program Summary PDF

Georgia Quick Start

For more than 40 years, Georgia Quick Start has provided customized workforce training free-of-charge to qualified businesses in Georgia. Today, the program is one of the state’s key assets for supporting new and expanding industries. Quick Start delivers training in classrooms, mobile labs or directly on the plant floor, wherever it works best for a company.

With this program, an employee with a disability can obtain the skills needed to advance in his/her career.

Investment Tax Credit

Companies in manufacturing or telecommunications support that have operated in Georgia for at least three years are eligible to earn investment tax credits for upgrades or expansions. Credit earned amounts to 1 percent to 8 percent of qualified capital investments of $50,000 or more.

http://www.georgia.org/competitive-advantages/tax-credits/investment/

Life Science Facilities Fund (application package)

The purpose of the Life Sciences Facilities Fund (the "Facilities Fund" or "LSFF") is to serve as an incentive program to provide low-cost loan assistance for the purchase of fixed assets to assist with the expansion, retention or relocation of life-science companies targeted by Georgia.

One of the goals of this fund is to create high quality jobs in the Life Science field. More jobs for people with disabilities who have experience and knowledge in this area could be a positive outcome of this incentive.

Life Science Facilities Fund Application Word document

Life Science Facilities Fund Regulations PDF

Mega Project Tax Credits

Mega Project Tax Credits benefit Georgia companies that employ a minimum of 1,800 "net new" employees; and have either a minimum annual payroll of $150 million OR make a minimum $450 million investment in Georgia. Companies meeting both requirements may claim a tax credit of $5,250 per job per year for the first five years of each net new job position. The credits are first applied to the company’s state income tax. Excess credits are eligible to be used against payroll withholding. In all cases, mega project tax credits may be carried forward for 10 years.

Workers with disabilities could be some of the "net new" employees to fulfill one of the requirements of this tax credit.

Military Zone Job Tax Credit

To be eligible for the Military Zone Job Tax Credit, businesses must be located within a currently designated Military Zone and creating jobs at that location. A business is not bound by enterprise definitions, but must create at least two (2) net new jobs within a tax year. They must be full-time, permanent jobs of at least 35 hours per week.

The goal of this tax incentive is to have businesses create job in community where military bases exist. Ultimately, the hope is to lower the poverty rate in these areas.

Military Zone Job Tax Credit Overview PDF

Military Zone Job Tax Credit Brochure PDF

Opportunities Zones

The Opportunities Zones incentive, available to new or existing businesses that create two or more jobs, is a Job Tax Credit which can be taken against the business’s Georgia income tax liability and payroll withholding tax. The credit is available for areas designated by DCA as an "Opportunity Zone".

Additional information on Georgia’s Opportunities Zones program.

Opportunities Zones Brochure PDF

Quality Jobs Tax Credit

The Quality Jobs Tax Credit is another job tax credit for jobs that pay higher-than-average wages. It can give Georgia companies a significant tax break and help drive growth. This provision rewards companies that create at least 50 jobs in a 12-month period - provided the jobs pay wages that are at least 10 percent higher than the county average for wages.

Companies that hire qualified people with disabilities to fill the newly created jobs can benefit from this tax credit.

Quality Jobs Tax Credit Application PDF

Regional Economic Business Assistance Program

The Regional Economic Business Assistance Program is an incentive program that is used to help "close the deal" when companies are considering Georgia and another state or country for their location or expansion. Regional Economic Business Assistance funds may be used to finance various fixed-asset needs of a company including infrastructure, real estate acquisition, construction, or machinery and equipment.

This assistance can be used to make a company’s workplace facility Americans With Disabilities Act compliant allowing for more employees with disabilities to be able to work in it.

Regional Economic Business Assistance Grant Program Regulations PDF

Research and Development Tax Credit

Research and Development (R&D) Tax Credits are a valuable benefit for companies developing new products and services in Georgia. R&D tax credits are available to any company that increases its qualified research spending. The tax credit earned is a portion of the increase in R&D spending. The credit can be used to offset up to 50 percent of net Georgia income tax liability, after all other credits have been applied.

The goal of this tax provision is to encourage Georgia companies to embark on more R&D projects. As more companies take on these endeavors, more career opportunities will emerge, including ones for people with disabilities.

Research & Development Tax Credit Application PDF

Retraining Tax Credit

Retraining Tax Credits enable Georgia businesses to offset their investment in employees. Businesses can receive a tax credit of 50 percent of their direct training expenses, with up to $500 credit per full-time employee, per training program. The annual maximum of the credit amounts to $1,250 per employee.

A business can retrain its employers, especially those who have disabilities. In doing so, the business will gain a competitive edge over its competition because of its newly retrained, highly skilled employees.

Tools for Life

Tools for Life, Georgia's Assistive Technology Act Program, is dedicated to increasing access to and acquisition of assistive technology devices and services for Georgians of all ages and disabilities so they can live, learn, work and play independently and with greater freedom in communities of their choice.

Vocational Rehabilitation Services for Employers

To meet the work force needs of business, the Vocational Rehabilitation Division provides an array of services to any business, without obligation to ultimately hire a person with a disability.